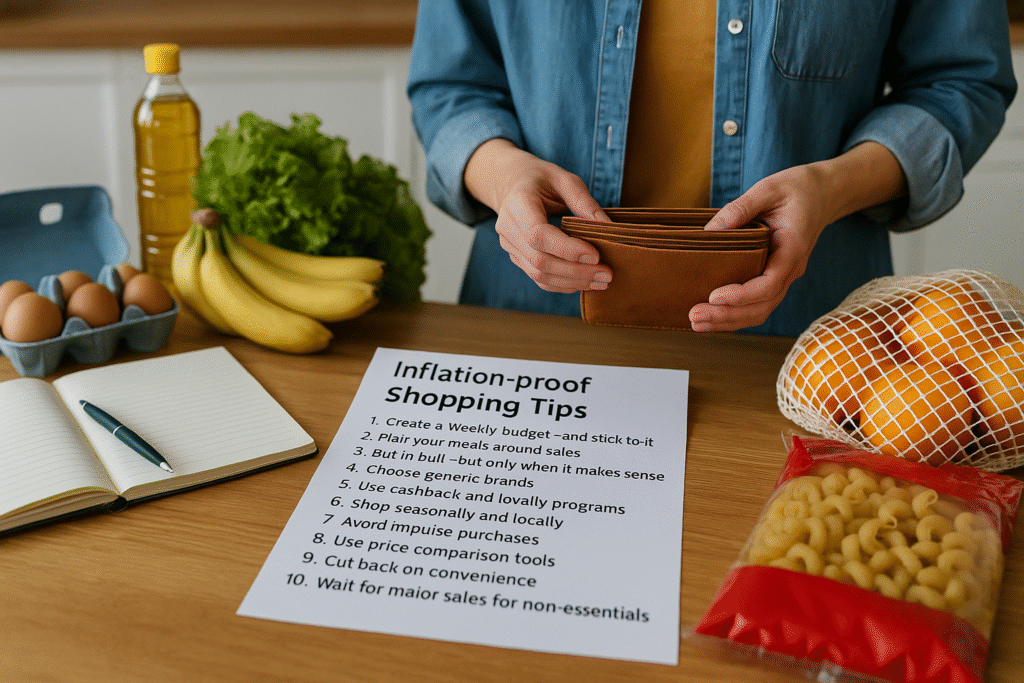

Discover 10 inflation proof shopping tips and how to apply.

Discover 10 practical tips for smart shopping and protecting your wallet from inflation. Save more by applying simple strategies.

How to apply for inflation proof grocery hacks

With rising prices affecting everything from groceries to gas, learning how to shop smartly is more important than ever. Inflation may be out of your control, but your spending habits aren’t. By adjusting the way you shop, you can stretch your money further and protect your budget.

Here are 10 inflation-proof shopping tips, and how to actually apply them in your everyday life.

1. Create a Weekly Budget and Stick to It

A budget helps you set spending limits and keeps you accountable. Write down your income and essential expenses. Whatever remains is your weekly shopping allowance.

Use tools like budgeting apps or a simple spreadsheet to monitor your spending. Leave some buffer room for unexpected needs.

2. Plan Your Meals Around Sales

Planning reduces food waste and helps you buy only what’s needed. Check store flyers or apps like Flipp for weekly deals. Choose recipes based on discounted ingredients. For example, if chicken is on sale, plan several meals using it and freeze portions for later.

3. Buy in Bulk—But Only When It Makes Sense

Buying in bulk often lowers the price per unit. Focus on non-perishables like rice, beans, pasta, and toilet paper. Compare the cost per unit before buying. Only buy perishables in bulk if you can store or freeze them before they spoil.

4. Choose Generic Brands

Store brands often offer the same quality as name brands at a lower price. Try replacing just a few of your usual items with generics, like cereal, cleaning products, or canned goods. If you can’t taste or see a difference, make the switch permanent.

5. Use Cashback and Loyalty Programs

These programs give you money back on purchases you’re already making. Sign up for store loyalty cards or cashback apps like Rakuten, Dosh, or Ibotta. Use them regularly and stack offers when possible (e.g., combine store discounts with cashback deals).

6. Shop Seasonally and Locally

In-season produce and local goods are often cheaper and fresher. Visit farmers’ markets or shop the produce section with seasons in mind. Strawberries in summer, pumpkins in fall—buying produce in its natural season avoids inflated prices from shipping.

7. Avoid Impulse Purchases

Why it works: Unplanned buys quickly inflate your spending. How to apply: Make a list before shopping—and stick to it. If you see something you want that’s not on the list, give yourself 48 hours to think about it. Most of the time, the impulse fades, and you save money.

8. Use Price Comparison Tools

Why it works: Prices vary widely between stores. How to apply: Use apps or websites like Google Shopping, ShopSavvy, or even Amazon to compare prices. If one store offers price matching, show them the competitor’s price to save instantly.

9. Cut Back on Convenience

Why it works: Pre-cut, pre-cooked, or individually packaged items are always more expensive. How to apply: Buy whole vegetables, cook from scratch, and pack your own snacks. For example, a block of cheese is cheaper than slices, and carrots are less costly than baby-cut ones.

10. Wait for Major Sales for Non-Essentials

Why it works: Timing your purchases can save you a lot. How to apply: Plan ahead for big-ticket items. Black Friday, back-to-school sales, or end-of-season clearances are perfect for buying electronics, clothes, or appliances. Create a wishlist and set up alerts to track price drops.

Final Thoughts

Inflation doesn’t mean you have to give up on quality or your lifestyle, it means you have to shop smarter. With these 10 tips, you can reduce waste, make more intentional purchases, and stretch your income further. The key is consistency: the more you apply these habits, the more natural they become.

Over time, they can lead to significant savings and greater financial control, even in unpredictable economic times.

So next time you’re at the store or browsing online, take a moment to pause, plan, and protect your wallet. Inflation might be rising, but your financial resilience can rise with it.