Embedded insurace: What is it, how does it work, and how much does it cost in the US?

Learn what embedded insurance is, how it works, and how much it costs in the US. Understand how this model makes protection simpler.

Understand what integrated insurance is

Insurance is often seen as a complex purchase. Customers know they need it, but the process of finding, comparing, and buying a policy can feel overwhelming.

That’s where embedded insurance comes in. This new approach integrates coverage directly into the products or services people are already buying, making protection more accessible and seamless.

In the United States, embedded insurance is gaining ground quickly, driven by consumer demand for convenience and digital-first experiences. But what exactly is embedded insurance, how does it work, and what does it cost? Let’s break it down.

What Is Embedded Insurance?

Embedded insurance is the practice of bundling insurance coverage into the purchase of a product or service. Instead of buying a separate policy, customers receive insurance as part of the transaction they are already making.

For example, when you book a flight online, you may see the option to add travel insurance at checkout. Similarly, when buying a new smartphone, retailers might offer device protection plans directly at the point of sale. These are both examples of embedded insurance in action.

The idea is simple: make insurance available at the right time, in the right place, and in the most convenient way possible.

How Does Embedded Insurance Work?

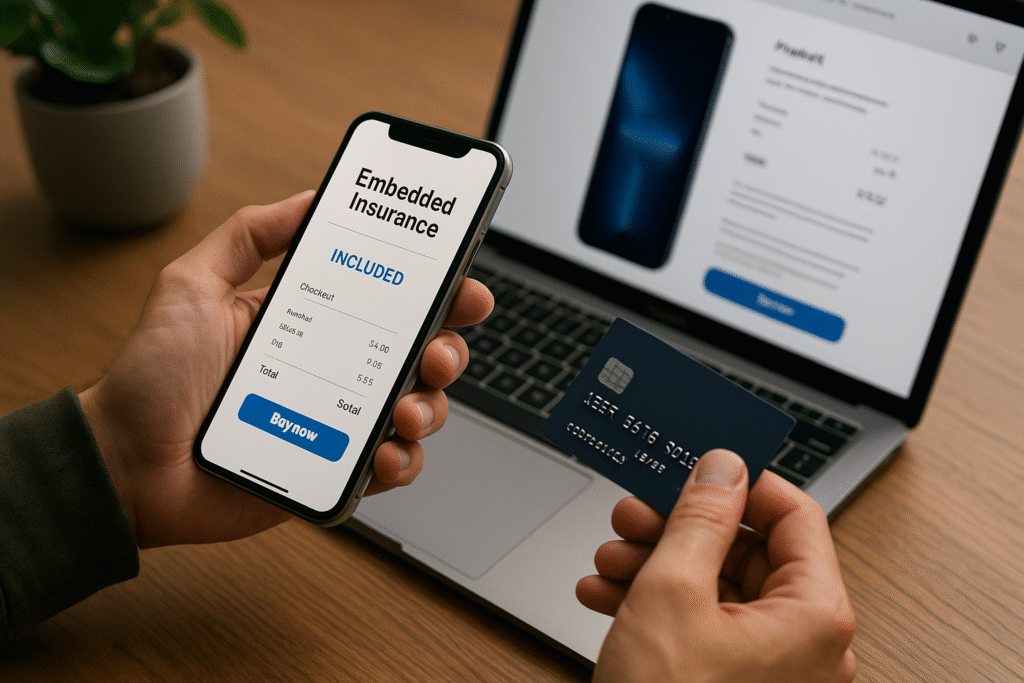

Embedded insurance works through digital integration between insurers and the platforms where customers shop.

Using APIs and advanced technology, companies can offer tailored insurance options within their checkout process or subscription models.

Here’s a step by step view of how it typically works:

- Purchase Trigger: a customer buys a product or service, such as a car rental, a concert ticket, or an online subscription;

- Insurance Offer: during checkout, the platform presents an optional insurance product that is relevant to the purchase;

- Seamless Enrollment: if the customer accepts, coverage is automatically added without the need for separate forms or lengthy applications;

- Policy Management: customers receive confirmation and can manage their insurance through the same platform where they made the purchase.

For businesses, embedded insurance creates an additional revenue stream. For consumers, it removes friction, making protection easy and often more affordable.

Examples of Embedded Insurance in the US

Embedded insurance is already part of everyday life in the U.S. Here are a few examples:

- Travel booking sites like Expedia or airlines offering flight protection during checkout;

- Ride-hailing apps such as Uber, which include accident coverage for drivers and passengers;

- E-commerce retailers offering extended warranties and protection plans on electronics;

- Car manufacturers partnering with insurers to provide built-in auto insurance with the purchase of a vehicle.

These examples highlight how embedded insurance meets consumers where they are, providing peace of mind at the exact moment of need.

How Much Does Embedded Insurance Cost in the US?

The cost of embedded insurance varies widely depending on the type of coverage, the provider, and the value of the product or service being insured.

In most cases, it is priced competitively because insurers save on distribution and marketing costs, passing some of those savings on to the consumer.

Here are a few typical price ranges:

- Travel insurance: Often between $15 and $50 for a domestic trip;

- Device protection plans: Around $8 to $15 per month for smartphones;

- Extended warranties: Usually 10–20% of the product’s price;

- Ride-hailing coverage: Built into the fare, so the cost is not separately visible to the customer.

One of the advantages of embedded insurance is transparency. Prices are shown at checkout, and customers can clearly see what is included before they make a decision.

Benefits of Embedded Insurance

The rise of embedded insurance benefits both consumers and businesses. For customers, the biggest advantage is convenience.

Instead of navigating complex comparisons and paperwork, coverage appears automatically at the moment it is most relevant.

This approach also makes policies more personalized, since the offer is directly connected to the purchase. In many cases, costs are more affordable too, thanks to lower distribution expenses.

For companies, embedded insurance creates new revenue opportunities. By integrating protection into the buying process, businesses can enhance customer loyalty and satisfaction, while reinforcing the perception of added value.

On the operational side, digital integration improves efficiency, reducing manual processes and enabling faster, smoother service delivery.

Final Thoughts

Embedded insurance is transforming the way Americans buy protection. By integrating coverage directly into everyday purchases, it simplifies the process, increases accessibility, and often reduces costs.

Whether it’s travel insurance at checkout, a warranty for your laptop, or built-in coverage for a rideshare trip, embedded insurance is becoming part of daily life.

As technology advances and partnerships expand, this model will continue to grow, reshaping the insurance industry and making coverage more customer-friendly than ever before.