Go to Insurance 2025: Step by Step Guide to Finding the Ideal Insurance

Discover how to choose the ideal insurance in 2025 with this practical step-by-step guide. Protect your health, assets and future.

Finding the right insurance has never been an easy task, and with accelerated digital transformations, regulatory changes, and new products on the market, the 2025 scenario demands even more attention.

If you are looking for protection for your health, car, home, or assets, this step-by-step guide will help you understand what to evaluate, where to look, and how to choose the best insurance for your needs. Check out the details below!

Step 1: Understand your life stage and priorities

The first step is self-assessment. What do you need to protect today? A young single person with a new car has different priorities than a family with children or a self-employed professional who relies on their own health to generate income. Here are a few examples:

- New car: comprehensive auto insurance with theft, collision, and third-party protection;

- Own home: home insurance against fire, theft, and natural disasters;

- Health and well-being: health plan or insurance with good hospital coverage;

- Income and stability: life insurance with disability or critical illness coverage.

List your priorities before looking for insurers. This helps avoid spending on unnecessary coverage or missing out on important protections.

Step 2: Research the main insurance companies on the market

With your goals defined, it’s time to research companies. In 2025, many insurers are investing in digital platforms, artificial intelligence, and personalized service. Prioritize companies with:

- Good reputation on sites like Reclame Aqui and Procon;

- Financial stability (check ratings from agencies like Moody’s and S&P);

- Fast and efficient service (testing the online chat is a good idea);

- Platforms that allow for simulation and 100% online contracting.

Tip: insurance apps or comparison tools like Minuto Seguros, Bidu, or Youse can make this step easier.

Step 3: Evaluate cost-benefit

The cheapest insurance isn’t always the best. The ideal is to analyze the cost-benefit ratio, that is, how much you are paying compared to what you are getting. Evaluate:

- What coverage is offered?;

- Are there extra services (like 24h roadside assistance, towing, locksmith, online medical consultation)?;

- Is the company’s customer service fast?;

- Does the company have a history of paying claims without bureaucracy?.

Cheap can be expensive if, in a moment of need, the insurance doesn’t work as expected.

Step 4: Consider personalization and flexibility

One of the major trends for 2025 is on-demand insurance. You only pay for what you need, when you need it. This is especially useful for:

- Self-employed professionals who want temporary health insurance;

- App drivers who only need insurance on certain days;

- Young people still living with parents who only want basic coverage.

Digital platforms are making this kind of customization available with just a few clicks. It’s worth considering if you’re looking for flexibility.

Step 5: Read reviews from other clients

Before signing up, check what other customers are saying about the insurer or broker. Use sites like Trustpilot, Google Reviews, or even social media groups. Evaluate:

- How the company treats clients after the sale;

- Speed in solving problems;

- Satisfaction rate in claim handling.

Companies with a good history usually have more agile service and fewer unpleasant surprises.

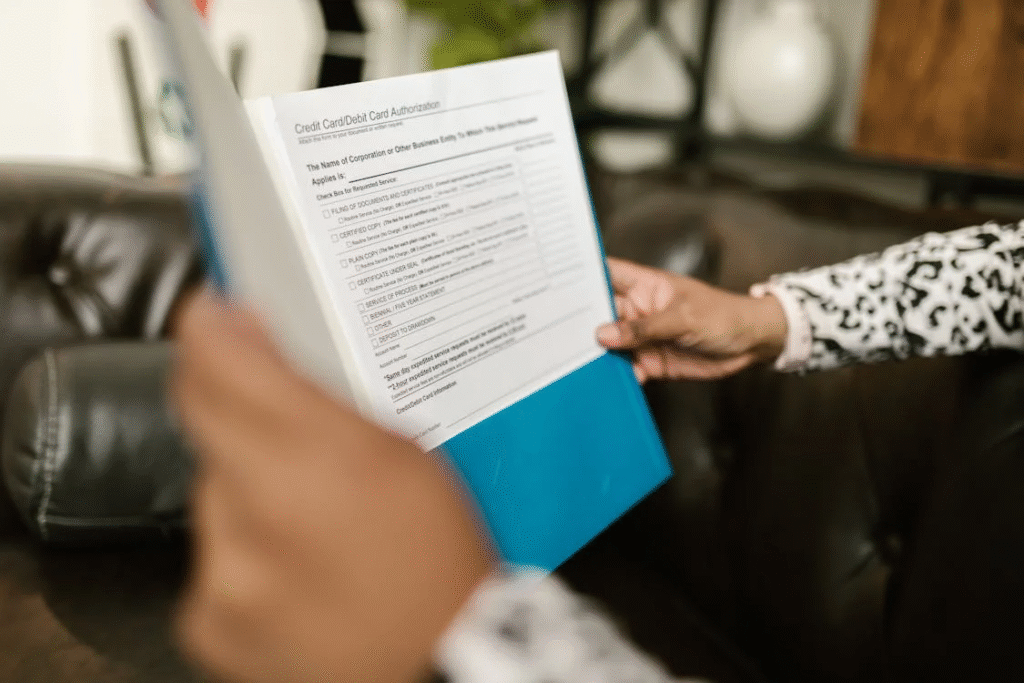

Step 6: Contract safely and monitor your policy

After choosing the ideal insurer, sign the contract through the official website, app, or with an authorized broker. Avoid unrecognized intermediaries. After the contract is finalized:

- Save the digital policy;

- Re-read the clauses;

- Enable notifications in the insurer’s app to receive alerts and updates;

- Check that payments are scheduled correctly.

In case of a claim or need to use the insurance, you will be prepared. Follow the guidelines to avoid any type of purchase during the process of purchasing your insurance in 2025.

Contracting the ideal insurance in 2025 requires attention, research, and planning. The market is more digital, personalized, and competitive than ever.

With this step by step guide, you have all the tools to make a conscious decision, protect what matters, and avoid future headaches. Remember: insurance is not an expense, it’s an investment in peace of mind.