Home insurance: what is it, how does it work and what coverage is available?

Discover what home insurance is, how it works, and the types of coverage available to protect your property and belongings from.

Understand home insurance coverage

Owning a home is a big dream, and often the biggest investment we make in life. That’s why it’s only fair to protect this asset with good home insurance. But what is home insurance? How does it work? And what coverage can you purchase?

If you have these questions, don’t worry. In this post, we’ll explain everything in a simple, straightforward way, without all the complicated legal jargon. Let’s go!

What is home insurance?

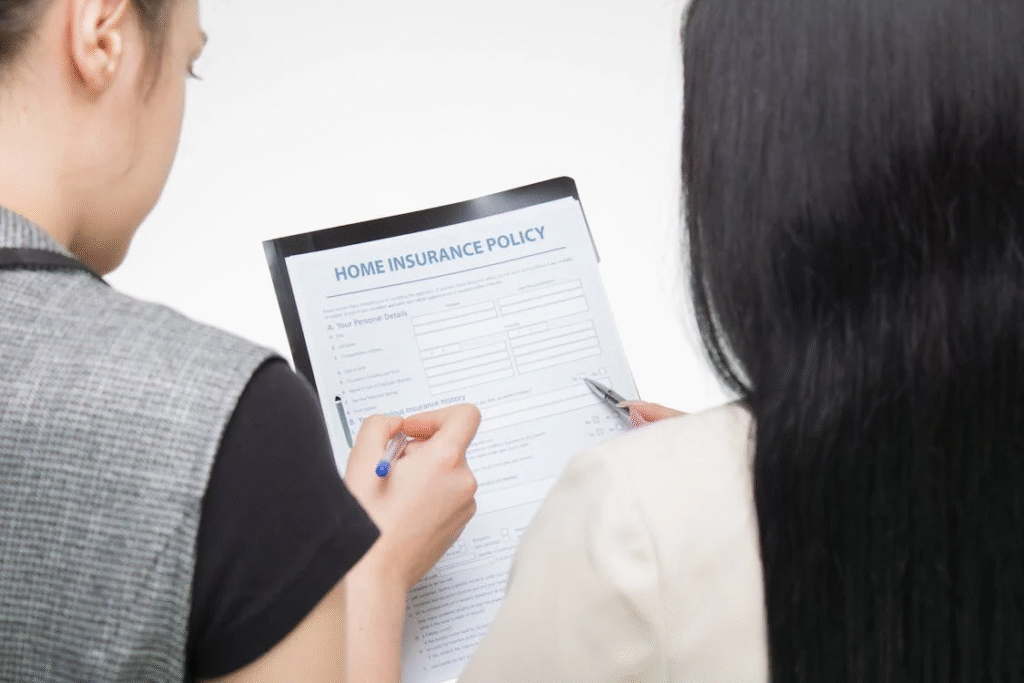

Home insurance is a type of coverage that protects your house against a variety of unexpected events like fires, theft, storms, and even electrical issues. It can cover owned or rented homes, apartments, and even vacation properties.

In practice, you pay a monthly or yearly amount for this protection. If something happens to your home or insured belongings, you can file a claim with the insurance company and receive compensation or assistance.

How does home insurance work?

It works similarly to other types of insurance. First, you get a quote based on the value of your property and the kind of coverage you want.

The insurer will assess the risk and offer a plan with a price (premium) and a deductible, that’s the amount you have to pay out of pocket in the event of a claim, depending on the coverage.

If something goes wrong, like a power surge that fries your fridge or a break-in, you contact the insurer, provide the necessary documents, and if everything checks out, you’ll receive payment to fix the damage or replace lost items.

What types of coverage are available?

One of the best advantages of homeowners insurance is that it is very flexible! Basic coverage usually includes a variety of options to ensure the safety of your property. Check out the main ones below!

- Fire, lightning, and explosion: covers damage caused by these events, including structural damage.

- Electrical damage: covers appliances damaged by power surges;

- Burglary and theft: compensates you in case of a break-in and stolen items;

- Personal liability: covers accidental damage caused by you or your family to others (like a water leak affecting your downstairs neighbor);

- Loss of rent or temporary housing: if your home becomes uninhabitable after an incident, this coverage pays for temporary rent or reimburses lost rental income.

In addition to basic protection, you can add extra coverage, such as:

- Storms, hail, and flooding;

- Broken windows and glass;

- Vehicle impact;

- 24/7 emergency assistance (plumbers, locksmiths, electricians, etc.);

- Emergency repairs;

- Coverage for high-value items (like artwork or electronics).

You can build a plan that fits your lifestyle and needs.

Is home insurance worth it?

That’s a common question, and in most cases, the answer is yes! Home insurance is relatively affordable compared to the protection it provides. Depending on the home and plan, it can cost as little as $60 a year.

Plus, it gives you peace of mind. You know that if something unexpected happens, you won’t be on your own to deal with it. And let’s be honest, having support when life throws a curveball is always helpful.

Tips for choosing the right home insurance

If you’re thinking about getting home insurance, check out these tips:

- Compare options: the cheapest plan isn’t always the best. Check the insurer’s reputation and the services included;

- Read the policy carefully: make sure you understand what’s covered, what the deductible is, and if there’s a waiting period for some services;

- Evaluate the value of your belongings: this helps set the right coverage amount for your contents (furniture, appliances, electronics, etc.);

- Consider adding 24/7 assistance: This can be a lifesaver for day-to-day issues and save you money on small repairs.

Final thoughts

Home insurance isn’t just an expense, it’s an investment in your peace of mind. It protects your property and gives you support when you need it most. The best part? It’s affordable and can be tailored to your situation.

If you don’t have home insurance yet, maybe now is the time to think about it. After all, we never know when the unexpected might happen, but we can definitely be ready for it.